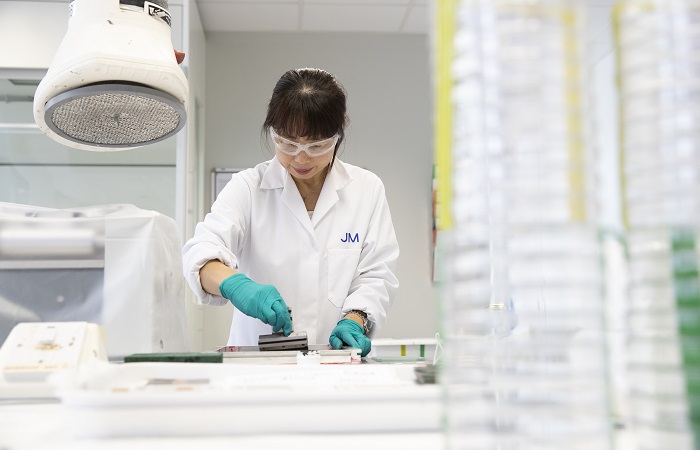

Johnson Matthey is a multinational specialty chemicals and sustainable technologies business, employing 4,300 people in the UK across 14 sites. Our workforce is very diverse, ranging from production workers to scientists.

Our pension scheme has a complex benefit structure, offering members different retirement savings options, encompassing career average revalued earnings, closed to new joiners, and a cash balance, offering different levels of membership with the flexibility to change options annually. There is also a defined contribution (DC) section which allows all members to top up their retirement savings, and which the organisation matches, up to certain amounts.

We want to ensure our colleagues are fully aware of the choices available and empower them to make informed decisions. At the same time, we do not want to overwhelm them with detail or influence them to take a particular course of action.

To do this, we maintain regular, direct interaction with our members, including visiting workplaces across the UK to give them opportunities to discuss their benefits and provide us with feedback on the support they need.

Time and again, colleagues have told us they want personalised information to help them make decisions reflecting their own circumstances, rather than having to rely on generic examples.

To help support this, our in-house team, working with our communications partner Ferrier Pearce, developed a bespoke online pension modeller. This is hosted on our benefits portal; once logged in, members can create personalised projections, simply by moving on-screen sliders and clicking ‘radio buttons’.

Members are then passed seamlessly and securely from our online benefits portal to our flex provider’s platform, using single sign-on, where they can choose their preferred scheme level.

Feedback on the modeller has been very positive; after it was introduced in early 2018 there has been a noticeable increase in the number of members actively adjusting their pension choices.

Also, since the modeller has been available, we have found that members attending workplace consultations tend to ask more specific questions about the details of the savings options, rather than needing the provisions to be explained to them from scratch. This has helped us extend the reach of our member engagement and, importantly, freed up time for us to add value in other ways.

Andrew Charman is head of UK retirement and savings plans at Johnson Matthey